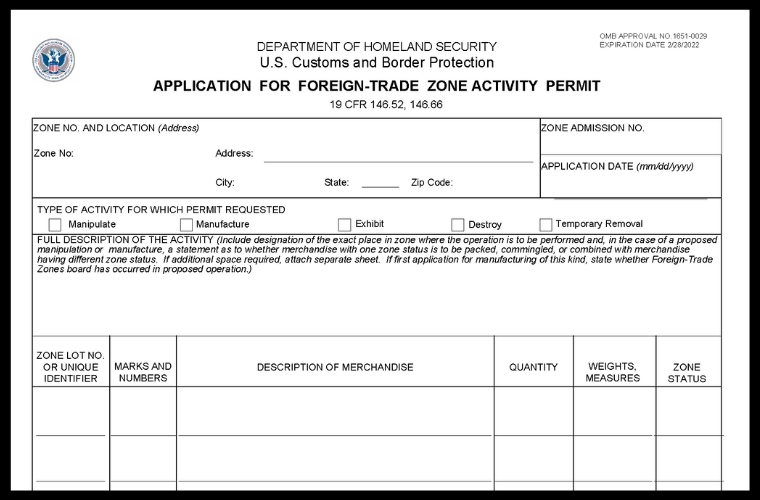

Importers who truly take advantage of all the benefits Foreign Trade Zones have to offer will become very comfortable using Form 216. With Form 216, a business can display products in an exhibit, relabel packages so they meet certain regulatory requirements, and even destroy goods, all while maintaining control of fees and tariffs. These are only a few examples of how Form 216 can be used; the list of benefits is extensive.

An importer can get an annual permit to perform certain activities, giving them complete autonomy over Foreign Trade Zone business operations.

When completing Form 216, there are a few things to consider:

- Importers and businesses are protecting themselves with this form.

- The form must be manually submitted to the CBP in triplicate.

- Businesses manipulate inventory and must keep records of all activity.

- Pictures are helpful! The more documentation of the activity the better.

- Be detailed. Provide a strong narrative on the form and if more space is needed, take it.

- Destruction can be done outside the Foreign Trade Zone.

- Harbor Maintenance Fees and other duties can be paid quarterly, improving cash flow.

- Annual permits are more blanketed in nature. More flexible, so keep all documents!

Customs forms can be confusing.

A strong resource that understands processes and has fostered deep relationships with the CBP, National Foreign Trade Zones, and Global Logistic Partners gives importers and exporters many paths to operate their business.